There are at least eight million elevators in the world and each one breaks down at an common price of 4 instances a year. Tens of heaps of human beings get trapped in them, frequently for hours on end.

Uptime is a Paris-based corporation which has developed science which can exhibit how a raise would possibly destroy down in future, so that its operator can get it constant in time.

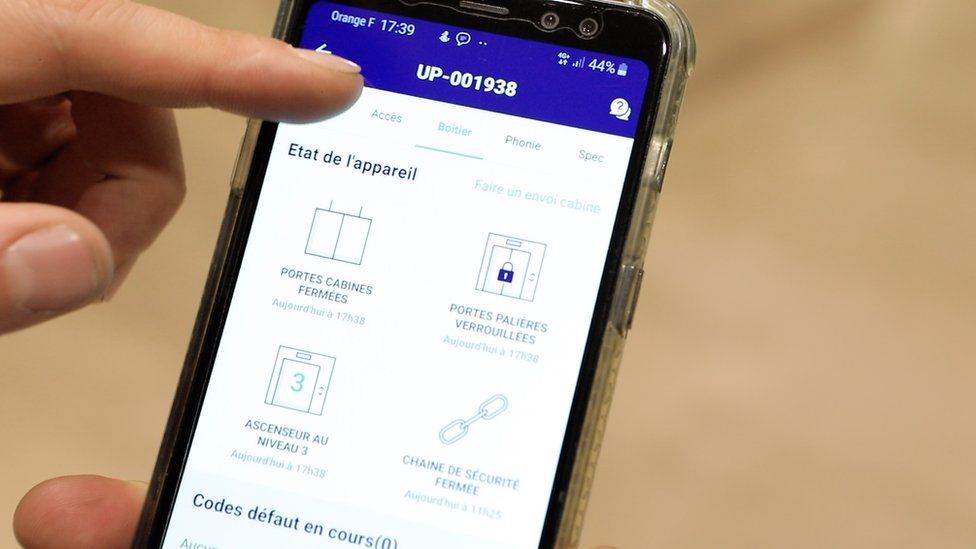

It keeps one thousand lifts in the Paris place and has bought its app to raise upkeep companies throughout the relaxation of Europe.

“The technological know-how we have is in a position to join to the laptop of each and every lift,” says Uptime’s co-founder, Augustin Celier.

“It can retrieve information from lifts of any brand. It detects anomalies in the lift’s overall performance and these anomalies can allow us, or others, to lift out preventative maintenance.”

Uptime’s ambition is to unfold its science throughout the relaxation of the world over the subsequent two years. Yet its boom may have been severely stunted proper from its begin in 2016, had Augustin and his fellow founder, Amaury Celier, taken up a tempting provide of a mortgage from a team of enterprise investors.

“Our company wasn’t even but incorporated,” says Augustin. “We did not even have a title or a website. But then we have been contacted by using some non-public investors, who have been collectively in a mission capitalist syndicate.

“They presented us a mortgage of €500,000 ($602,600: £431,000), even though at the very commencing we truely solely wanted a tenth of that.”

‘Taking dangers is how we determined our edge’

‘The stress of being a boss made my hair fall out’

How a friend’s pug stimulated a teen’s dream business

Talking to guys about bras can be ‘awkward’

‘My billion pound corporation has no HR department’

The syndicate stated they were impressed with the aid of the market possibilities of Uptime’s science and the exceptional of its team. They desired to make investments proper away.

“We had been extraordinarily tempted to take the money,” says Augustin. “It gave us an positive feeling of: ‘Wow! We have human beings who already have faith us so early on in the journey’.”

However, when Augustin and Amaury Celier examined the important points of the offer, they sensed it may want to smash their plans for Uptime.

“Conditions have been awful in the lengthy term,” says Augustin. “If we had taken the offer, we would have been giving possibly 1/2 the organisation to them after two years. And we may no longer have been in a position to appeal to extra buyers after that, due to the fact most of the enterprise had already offered to anybody else.

“We would possibly now not have been capable to elevate greater cash, so possibly the organization would now not even exist today.”

Augustin says Uptime raised a smaller sum of cash from different buyers on much less harsh terms. However, he says, some entrepreneurs would possibly take delivery of the kind of provide which he refused due to the fact of the mentality of many businesspeople to see the upside of offers as a substitute than their downside.

“Always seem out for your ‘optimism bias’,” he says, “because when you are an entrepreneur you constantly hear solely what you desire to hear. When it is positive, you hear it and when it is negative, you definitely do not hear it.

“My recommendation is that it is higher to have no cash than dud money, or the incorrect money. I be aware of there is a opposite view. Everybody advises in opposition to that, saying: ‘If there may be a cookie on the table, you need to take it.’

“Actually, I assume that is incorrect and you must now not take cash which is no longer proper for your company.”